21st Mar,2022 – Agile Intel Research

The global 5G services market was valued at US$45,680 million in 2021 and is estimated to grow at a compound annual growth rate (CAGR) of 44.1% between 2022 and 2029, mainly driven by the exponential rise in data traffic and growing demand for high-speed data connectivity. The planned deployment of 5G networks in smart cities growing adoption of IoT is also expected to drive the 5G Services market growth.

AgileIntel’s global 5G services market study is a 172 slide report containing in-depth analysis on historical and forecasted spending patterns in the sector. The study offers granular value data from a global, regional, communication technology, and vertical perspective.

5G services commercialization started in 2020. Hence, the base year is 2021 for the study with historical data available for 2020. The data forecast has been provided for the years between 2022 and 2029.

Key insights from the Global 5G Services report

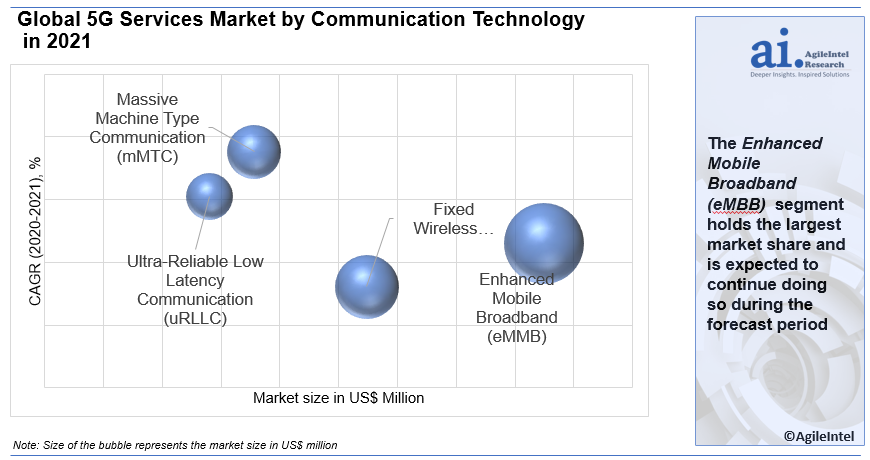

Insights on Communication Technology:

The 5G services market is classified into Enhanced Mobile Broadband (eMBB), Fixed Wireless Access (FWA), Massive Machine Type Communication (mMTC), and Ultra-Reliable Low Latency Communication (uRLLC) based on the communication technology.

The Enhanced Mobile Broadband (eMBB) segment, also known as extreme mobile broadband, dominated the market in 2021 and is expected to grow considerably over the forecast period. It is the extended version of 4G network services and can deliver ultra-high wireless bandwidth capabilities in applications such as high definition (HD) video streaming and immersive virtual reality (VR)/augmented reality (AR) gaming and video calling, providing faster download speed and improved user experiences.

The massive Machine-Type Communications (mMTC) segment is expected to grow exponentially during the forecast period. The 5G mMTC technology provides high bandwidth connectivity for heavy density applications such as smart cities, remote asset monitoring, etc. The rising need for high-speed connectivity for all IoT devices deployed in a network is expected to boost the mMTC segment growth during the forecast period.

Insights on Verticals:

The 5G services market is categorized into telecom and IT, energy and utility, media and entertainment, manufacturing, transportation and logistics, aerospace and defense, healthcare, and others based on verticals.

The telecom and IT segment dominated the market with a share of more than 21% in 2021.The growing demand for high speed internet connectivity for residential and commercial applications is expected to boost the telecom and IT segment growth during the forecast period. Organizations are adopting advanced technologies such as cloud-computing and multi-vendor connectivity that need high-speed network connectivity offered by 5G for uninterrupted operations, thereby driving the market growth.

The growth in renewable energy and grid digitization is significantly affecting the energy and utility companies thereby driving the need for implementation of IoT devices, sensors, and other connected equipment to facilitate data transfer efficiently and quickly. With extremely low latency and high data and the ability to support multiple connected devices, 5Gis expected to improve asset integrity, reduce risk and enable remote monitoring of production sites.

Furthermore, the manufacturing sector is progressing towards implementation of advanced technologies for factory automation. This requires wireless communication systems that function using high-speed, uninterrupted connectivity offered by 5G services. For instance, automotive manufacturers such as BMW, General Motors, and Ford Motors are making significant investments in deployment of IoT, AI and ML technologies in their factories to reduce their time-to-market.

Figure 3: Global 5G Services Market by Vertical in 2021

Insights on Regional Growth:

Asia Pacific is the largest market for 5G services globally. Market players in APAC region such as China Mobile, China Telecom, SK Telecom, and KT Corporation are making significant investments in rolling out 5G network infrastructure in China, Japan and South Korea. Moreover, manufacturers such as Huawei Technologies, Samsung Electronics, and BBK Electronics Corporation are continuing to launch 5G-enabled smartphones which is likely to drive growth in the region.

Meanwhile, North America accounted for 27% of the 5G services market in 2021. The 5G rollout in North America is delayed due to the escalating trade war between the U.S. and China. The U.S. is one of the largest importers of Infrastructure equipment from China. Due to geopolitical tensions between these two countries, the U.S. government has urged other countries to review the role of Chinese firms in 5G networks, suspecting their equipment is being used for cyberespionage. The absence of major 5G equipment suppliers from the domestic market is expected to reduce price competition and higher deployment costs. The move is expected to increase the CAPEX of operators and delay the 5G rollout in the U.S.

Figure 4: Global 5G Services Market by Region in 2021

Insights on Key Markets:

The U.S. is the largest market for 5G Infrastructure products and services, capturing 25.6% of the global market share and is valued at US$ 11,685.9million in 2021. The surge in the number of smart cities across the country and favorable regulations promoting 5G deployment is expected to drive the market growth in the region.

The 5G Infrastructure market in China was pegged at US$ 10561.3 million in 2021. The market is expected to grow rapidly during the forecast period, mainly due to the presence of leading 5G equipment manufacturers such as ZTE and Huawei. The growing investments by Chinese telecom companies to upgrade their networks and deploy 5G RAN across major cities, including Shanghai, Beijing, Shenzhen, and Guangzhou, is expected to boost the market positively. These cities have also formulated roadmaps and local strategies to promote the development and deployment of 5G technologies. China has also constructed over 180 million 5G terminal connections and around 700,000 5G base stations. China Telecom, China Unicom, and China Mobile have announced pilot DSS solutions across a few provinces in co-operation with suppliers such as Huawei, ZTE, and Ericsson.

Figure 5: Global 5G Services Market by Key Countries in 2021

Market dynamics

Trends

The deployment of millimeter wave (mmWave) technology based standalone 5G (SA 5G) networks is likely to take precedence over non-standalone 5G (NSA 5G) technology, which has been used in most of the commercial deployments till date. NSA 5G uses new radio technologies, implemented on an underlying 4G core, thus offering better bandwidth and performance than 4G. However, it is nowhere close to the true potential of the mmWave based SA 5G networks, which can reach 10 times the speed of 4G, and unlock several application areas consumers and business. Thus, as the implementation of SA 5G networks gains momentum, the practical application of advanced IoT, robotics, and AR/VR in industrial use cases can finally be a reality.

Drivers

The growing demand for high-speed data for commercial, industrial, and personal applications is expected to drive the demand for 5G services. The proliferation of smartphones, tablets, and smart TVs has led to increasing internet use for browsing, streaming videos, and video calling, among others. The resultant increase in data traffic has, in turn, created a need for high-speed data connectivity to provide a seamless experience to users. The commercialization of 5G-enabled services is anticipated to create numerous uses ranging from simple applications such as Virtual Reality (VR) & Augmented Reality (AR) gaming and Ultra-High-Definition (UHD) video streaming to more complex applications, including robotic surgeries, autonomous vehicles, and autonomous defense equipment. Thus, the advent of next-generation technologies is expected to drive the demand for high-speed, low latency data connectivity and the demand for 5G services.

Opportunities

5G and cloud are likely to evolve into two interdependent technology platforms that would grow together and support each other during the forecast period. The combination of cloud technologies and 5G services is anticipated to enhance the flexibility, operational capacity, and functionality of many industries. High-speed data connectivity coupled with reduced latency levels that 5G network services offer would encourage organizations to shift toward cloud-based solutions. Moreover, they are expected to pave the way for several investment opportunities for cloud businesses. For instance, 5G technology is anticipated to enable cloud service providers to use their mobile phones for remotely accessing machines, thus making it easier and more reliable for them to offer their services to mobile enterprise customers. Thus, the growing adoption of cloud services is expected to support the 5G market growth during the forecast period.

Challenges

The increased cost of 5G spectrum coupled with high infrastructure costs associated with the deployment of 5G services is expected to result in higher subscription fees to avail 5G services. Telecom service providers are charged a high fee by the government or telecom regulating authorities to buy the license or rights to transmit signals over specific electromagnetic spectrum bands. Moreover, governments worldwide release only a limited band to be licensed by telecom operators. These factors are expected to hamper the growth of the 5G services market. For instance, the Telecom Regulatory Authority of India (TRAI) has recommended base price of INR 492 per MHz for 5G spectrum within the 3300 MHz to 3600 MHz band. These high spectrum costs are likely to directly affect the consumers and hamper the development of 5G services over the forecast period.

Impact of COVID-19

The COVID-19 pandemic has significantly impacted the global economyand, subsequently, 5G roll-out and infrastructure deployment. Governments across the world have issued strict lockdowns and travel restrictions leading to labor shortage and complete disruption of supply chain and logistics operations, delaying the deployment of 5G Infrastructure.As a result, there has been a notable decline in the imports and exports of 5G equipment from major manufacturing hubs, including China, the U.S., Korea, Taiwan, and other key European countries. This, in turn, has further delayed the deployment of the next-generation network infrastructure worldwide.

Scope of the Global 5G Services report

This report provides analysis of the latest industry trends and estimates revenue growth at global, regional, and country levels. For this report, AgileIntel has segmented the global 5G Services market report based on communication technology, vertical, and region:

Insights on Communication Technology (Revenue in US$ million, 2020-2029)

Enhanced Mobile Broadband (eMMB)

Fixed Wireless Access (FWA)

Massive Machine Type Communication (mMTC)

Ultra-Reliable Low Latency Communication (uRLLC)

Insights on Vertical(Revenue in US$ million, 2020-2029)

Telecom & IT

Energy & Utility

Media & Entertainment

Manufacturing

Transportation & Logistics

Aerospace &Defense

Healthcare

Others

Insights on Regional market (Revenue in US$ million, 2020-2029)

North AmericaU.S.

Canada

Mexico

EuropeU.K.

Germany

Italy

France

Spain

Asia PacificChina

Japan

India

South Korea

South AmericaBrazil

Middle East and Africa

Objectives of the report

To define, describe, and forecast the 5G services market based on communication technology, vertical,region, and selected countries.

To analyze and forecast the 5G services market segments (communication technology and vertical) based on major regions such as Asia-Pacific, North America, Europe, South America, and Middle East and Africa. The report offers cross sectional data points (segments by region and country)

To analyze and provide information on various market dynamics including trends, drivers, opportunities, and challenges that directly or indirectly influence the market during the forecast period.

To analyze and provide details of a competitive landscape for market leaders.

To analyze recent developments in terms of operational and strategic changes such as new product developments, capacity expansion, alliances, joint ventures, and mergers & acquisitions in the market.

Report Parameters

Details

Time Period Considered

2020-2029

Historical Period

2020-2021

Forecast Period

2022-2029

Units considered

Revenue in US$ million

Report Coverage

Value/Revenue forecast, competitive landscape, drivers, challenges, opportunities, and trends

COVID-19

Impact of the COVID-19 pandemic has been factored in the revenue estimations, trends, and drivers

Segments

By Communication Technology By Vertical By Region

Regions included in the study

Asia Pacific (APAC), North America, Europe, Middle East and Africa, South America

Companies Profiled

AT&T, Inc., China Mobile Ltd., China Telecom Corporation Ltd., China Mobile Ltd., Bharti Airtel Ltd., Vodafone Group, Deutsche Telekom AG, SK Telecom Co., Ltd., Saudi Telecom Company